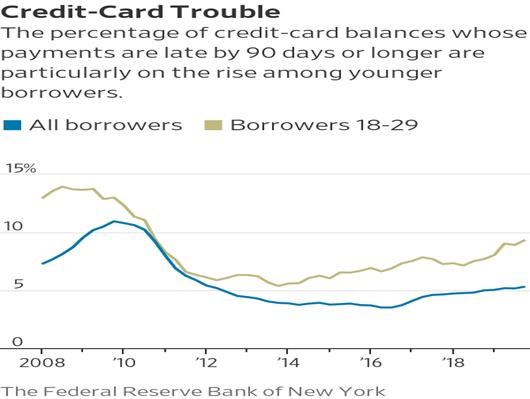

Serious delinquencies increase, particularly among younger borrowers

WASHINGTON—Credit-card debt rose to a record in the final quarter of 2019 as Americans spent aggressively amid a strong economy and job market, and the proportion of people seriously behind on their payments increased.

Total credit-card balances increased by $46 billion to $930 billion, well above the previous peak seen before the 2008 financial crisis, according to data released by the Federal Reserve Bank of New York on Tuesday.

Some cardholders, particularly younger ones, are running into trouble.

The proportion of credit-card debt in serious delinquency, meaning payments were late by 90 days or more, rose to 5.32% in the fourth quarter, the highest level in almost eight years, from 5.16% in the third quarter. The serious-delinquency rate for borrowers from 18 to 29 years old rose to 9.36%, the highest level since the fourth quarter of 2010, from 8.91%.

Read the full article here.