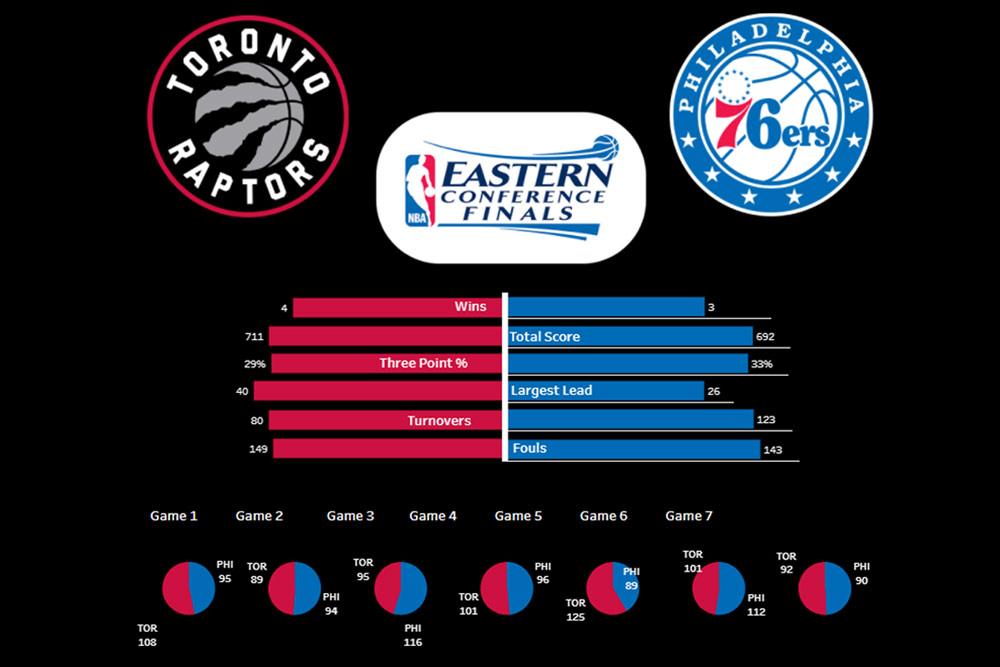

PAG capabilities for NBA Eastern Conference Finals.

May 11, 2021

Sports

PAG capabilities for NBA Eastern Conference Finals.

Managing Partner of U.S. Operations

Mr. LaRoche is a resourceful, results-oriented Executive with over 25 years of financial services experience; emphasizing collections risk management, dialer operations, MIS and reporting analytics, acquisition strategies, loss forecasting, credit policy, account management strategies, portfolio conversions, due diligence, and collections operations management. He also has over 15 years of direct risk management experience, with 3 years of collections line management experience possessing excellent analytical skills and the ability to manage diverse groups in strategies, modeling, collections, dialer operations, loss forecasting/loan loss reserve modeling, financial analysis, operations and loss avoidance.

David started his career in 1997 as a customer service representative for Travelers Bank. Since then, he has held the following senior positions:

Chief Risk Officer

Chief Data and Analytics Officer

Mr. Ridgeway has over 30 years of experience within the financial services industry, including Risk Management, Finance, Project Management, Compliance, MIS, IT & Operations. He has held senior roles at several of the top 5 Banks, including MBNA, Wells Fargo & Citibank. Dee has expertise in Risk oversight and a wealth of knowledge in the regulatory footprint (CFPB / OCC / FRB) in financial services. He has hands-on knowledge in the strategy world with numerous credit products including: credit cards, auto lending, mortgage and home equity, and unsecured lending. Dee is a co-founder of Predictive Analytics Group, worked as a Senior Consultant for Hoops Consulting, LLC., and owned & operated Mayflower Analytics LLC.

From a Risk Management perspective, Dee has experience in portfolio management in credit underwriting and loss mitigation during several growth cycles and economic contraction periods. He understands the needs and partners well with operational risk, modeling, and loss forecasting risk functions.

Dee is a SME on risk data strategy (data architecture, data management, and systems integration) and often creates a "passable bridge" between Risk and IT that translates business needs into executable business plans.

From an MIS, reporting, and portfolio analytics perspective, Dee has a proven track record of designing portfolio reporting that meets executive and end user needs that often have been labeled the "gold standard."

CEO and Chief Strategy Officer

Mr. Hoops has over 25 years of experience within the financial services industry, including Credit Collections & Fraud Risk Management, Business Operations, Control &Compliance, Strategic Planning, Forecasting, and Marketing Analytics. He has served as a Chief Risk Officer for Barclaycard US Partnerships, a Global Scoring Head at Citibank, and a Site President for Wells Fargo Financial. Steve is a co-founder of Predictive Analytics Group and has owned & operated Hoops Consulting, LLC for the past 4 years.

Steve started his financial services career in 1993 as a part-time telemarketer while attending the University of Delaware for his Business Administration degree. Mr. Hoops has spent his 25-plus years within the industry building best-in-class operations with each company he has supported. His career has been highlighted by leading several large functions for several Tier 1 and Tier 2International Banks, including: