By David LaRoche

Over the past few years, we’ve helped financial institutions conduct due diligence before partnering or supporting a fintech that wants to enter the credit-card market.

Generally speaking, we advise them to consider the fintech’s experience in the credit industry, its pricing model, its ability to scale and grow – and whether the bank can help without exposing itself to unreasonable risk. We also recommend the bank consider the fintech’s technology and its ability (and willingness) to improve product offerings, increase efficiency, and lower costs.

We recommend the bank detail its expectations and take a project-based approach: Who needs to know what by when? A big early discussion: Share risks with the fintech partner and determine what each one does best and how they should present a united front to regulators and other outside organizations.

Here are five things we tell them to consider before we ever discuss helping them vet the fintech.

Is the fintech and its partners well capitalized.

This is generally the threshold for most fintech’s to support the numerous operational investments needed to successfully launch a card portfolio.

Does the fintech have a strong affinity to its customer base, and does the card they are offering have a good value proposition? Affinity-card issuers such as the former MBNA America (now Bank of America) found that customers carrying the card of an organization, professional group, or alma mater were less likely to fall behind on payments or default on their loan either because of their demographics or because of a (misplaced) fear that the organization might find out.

In terms of the value proposition, the fintech may be able to offer something that the financial institution doesn’t. This includes:

- New ways to assess creditworthiness (e.g., going beyond a credit score to offer banking products to those who might otherwise not qualify).

- Products specifically designed for customers with low credit scores or no credit scores to help them build (or rebuild credit). These products often come with a higher APR or an annual fee to reduce risk to the institution.

- Custom card rewards. This may get back to affinity, or it may involve other partnerships. There are probably no better examples than travel-rewards cards (miles tied to spending) and collegiate cards, particularly those offered through athletic departments that might offer access to tickets or other experiences.

- Hybrid cards that combine a credit card with an installment loan that could include debt consolidation.

- Cashback cards that can be used to save money on purchases, buy gift cards, or pay off balances.

Does the fintech bring any next-level technology to excite the customer base? This is one you can test by looking at their website or mobile app and during conversations about investments that might also reduce risk concerns:

- Automated credit scoring and monitoring services, which are admittedly already offered fairly widely by people like Credit Karma and Experian.

- Electronic invoicing and online customer portals, both of which can help financial institutions reduce late payments and mitigate credit risk.

- Mobile payment apps such as Apple Pay or Google Pay that use tokenization to allow customers to pay without exposing their actual credit card account number.

Does the fintech plan to invest in critical infrastructure like compliance and data capabilities? There are three broad categories of risk in these types of partnerships:

- Reputational, which occurs whenever any new product or service is introduced, regardless of whether it was developed in-house or by a third party.

- Regulatory, which is likely a priority for any financial institution, particularly given (1) recent events and (2) the likelihood that it could be a long time before banking regulations are changed to address fintech products.

- Unforeseen, fintech’s may have limited experience dealing with regulations and regulators. For banks, this risk can be avoided if you choose to partner with a more experienced fintech (or one that has leaders with experience in the credit card business).

If a Sponsor bank is involved, are there qualified people at the fintech to manage the relationship? As noted above, a LinkedIn search of top executives across operations, revenue generation, credit, and collections can answer this question, as can simply asking, “Who’s got credit card experience?”

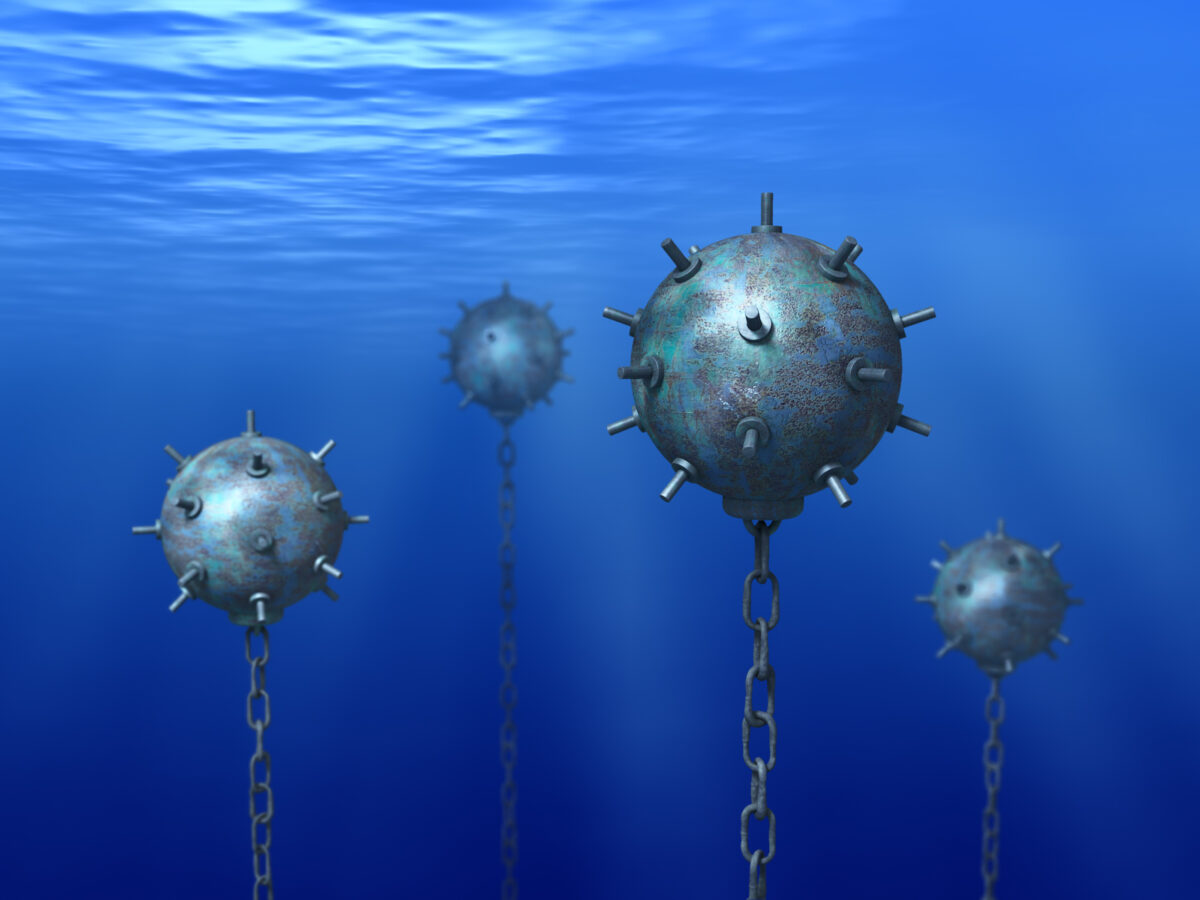

Entering into a relationship with a fintech requires proper due diligence from stakeholders – or consultants – who understand the minefields, or at least some of the significant differences between the two of you. PAG can manage this process to ensure the partnership is optimized, compliant, and profitable before the final contract is signed and even afterward as results start coming in.

David LaRoche is the managing partner of U.S. operations for Predictive Analytics Group. Our proprietary GOBLIN enterprise data platform helps clients consolidate data from multiple legacy systems, overcome a lack of in-house advanced analytics experience, and identify new segmentation opportunities to improve portfolio growth and profitability.