Does your organization face any of these common data challenges?

- Your legacy data systems don’t talk to each other.

- Your data files are difficult to work with and not in one place.

- Your reports and analytics are inconsistent, untimely, and ultimately untrustworthy.

- File sharing is inconvenient, role-driven, or secure.

Predictive Analytics Group – powered by GOBLIN – helps clients address these issues, providing you with customized solutions that deliver rapid results through comprehensive data aggregation.

What is GOBLIN?

Goblin is an enterprise data platform that helps customers consolidate data from multiple legacy systems; overcome lack of in-house advanced analytics experience; create a full in-house reporting suite and control access to those reports; and identify new segmentation opportunities to improve portfolio growth and profitability.

GOBLIN was built by Predictive Analytics Group’s senior analytics experts who have specific subject matter expertise. GOBLIN costs a fraction of the price of our competitors and will be tailored to your business needs.

Our experts have decades of client-side management experience, helping clients in a variety of industry verticals identify and resolve challenges through changing business models and economic cycles.

“We’ve been really happy with the way PAG has worked with our business units and vendors to identify requirements, provide advice on different iterations, and support integration across our stakeholders. That’s not something you usually see – you often see people push for implementation of a cookie-cutter product. Not PAG.”

CEo – Midsize card issuer

How Does GOBLIN Work?

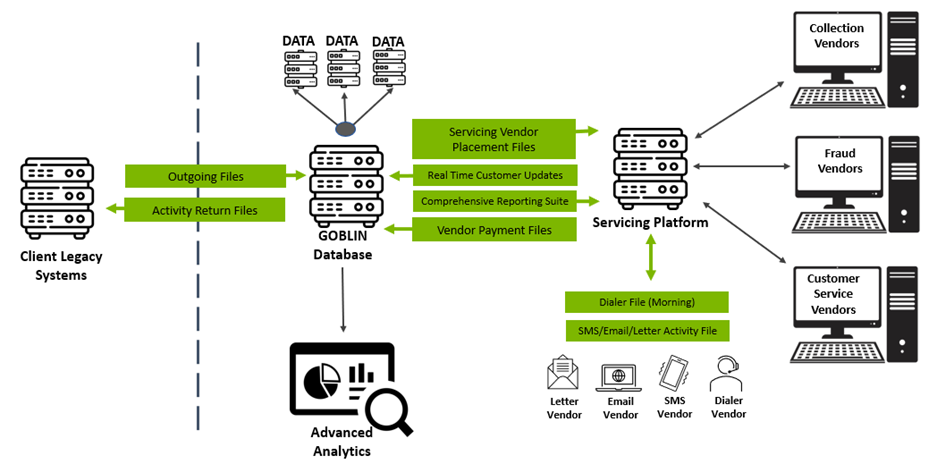

By bringing together components of File Sharing, Data Warehousing and Business Intelligence, GOBLIN reduces operating costs, creates enterprise efficiencies, and delivers immediate financial impact.

When GOBLIN is used as the central hub to merge and cleanse data, distribute files and reporting, and perform advanced analytical exercises, clients save an average of 30% on infrastructure costs and spend more time making decisions to run their business.

We’ll assign a preconfigured team of data architects, database analysts, business analysts, and risk managers who will hit the ground running, immediately saving your enterprise time and money.

The GOBLIN platform comes with prebuilt software licenses, including Azure, relational databases, and Tableau. These will save you time and take advantage of the scale we bring.

You’ll gain instant access to 20+ years of accelerators and experienced personnel across file sharing, data transformation and proprietary BI solutions, enabling your enterprise to reap the value of our experience.

Key features

- File Share: Allows clients to ingest vendor files and data, and also produce and automate outgoing data feeds.

- Data Warehouse: SOC2 Certified and PCI-Compliant, our warehouse enables clients to store and clean data at any time using prebuilt software, including Azure, Tableau, and relational databases.

- Data Security: GOBLIN offers the most secure multi-layered environment available for your data, including IP restrictions, multiple firewalls, geo-location backup, active directory integration, and role-based security.

- BI Tool: Our Business Intelligence tool provides secured access to query data, automated report creation, and both data virtualization and visualization for rapid intelligence and reporting.

- Interface: Each Customer portal will be branded to look like your product offering and company marketing profile.

“Our current production reports [with GOBLIN] give me an end-to-end view of loan production and portfolio performance. The presentation through Tableau is clean and the daily updates run on time and have been consistent. The GOBLIN team has been a steward of data security, recommended best practices, and enforced proper procedures when others wanted to take shortcuts.”

CeO – medium-size payday lender

Relevant Articles and Case Studies:

-

Call Center Optimization Can Combat Rising Delinquencies

By David LaRoche As delinquencies and charge-offs rise, financial institutions must strive for call center optimization. At Predictive Analytics Group, we’ve seen how advanced analytics and AI can transform collection strategies and mitigate losses. Here’s how executives are addressing these challenges and why partnering with analytics experts is crucial. The Power of Predictive Analytics in…

-

From TDs to Turnarounds: How Our FUN NFL Hobby Helps Us Tackle Your Business Challenges

In football and finance, accurate predictions are the difference between victory and defeat. Here at Predictive Analytics Group, we love building predictive models that help our clients increase revenues and reduce risk. But we also admit to being “nerds” with analytics; in fact, we love to build models in our free time that make our…

-

Revolutionizing Collections: How Machine Learning and RPA Are Slashing 90+ Day Delinquencies

By David LaRoche I’m getting calls these days from consumer lenders concerned about surging delinquencies and struggles with traditional collection methods. The conversation normally pivots we can help them leverage Machine Learning Models (ML) and Robotic Process Automation (RPA) to tackle concerns over 90+ day delinquencies. For context, Machine Learning Models spot patterns in vast…

-

Navigating the Data-Driven Landscape: Why Your Business Needs a Comprehensive Analytics Solution

Have you ever felt overwhelmed by the sheer volume of data from various sources, making it tough to make confident decisions? Without a comprehensive data-analytics platform merging predictive and prescriptive analytics to uncover meaningful insights and informed decisions might seem like a Herculean task. Predictive Analytics: Seeing into the Future Imagine being able to identify…

-

Unlock the Power of Data in Portfolio Acquisitions

Revolutionize credit portfolio acquisition with data analytics. Make data-driven decisions, bid competitively, and close deals faster with Predictive Analytics Group.

-

From Reactive to Proactive: Transforming Collections with Data Insights

With charge-offs and delinquencies hitting recent highs, the stability of your credit portfolio may be at risk. At first glance, issuers have lost some of the tools in their tool belts to help delinquent customers get back on track with their payments. Delinquencies and charge-offs were less of an issue during the pandemic. The New…

-

PAG helps portfolio buyer assess health of future acquisitions

Challenge: A large portfolio buyer had seen disappointing results from a few previous acquisitions. In one case, a runoff portfolio acquisition’s credit losses exceeded projections, and in another, a few card portfolios were growing slower than expected. Management was under immense pressure to acquire its next set of acquisitions at a profitable margin with upside…

-

PAG’s GOBLIN software helps investment company make sound purchasing decisions

Challenge: An investment company was considering purchasing multiple portfolios within two lines of business and needed help with due diligence, particularly to validate pricing to ensure the investment met its expectations. Limited historical data was available due to the age of the product, and the investment company lacked the datasets to build a sufficient model…

-

GOBLIN provides strong blend of cost and functionality with a platform offering predictive and prescriptive analytics

We spent a great deal of time in recent months talking to customers and prospects about how we could beef up our GOBLIN 2.0 enterprise and data analytics platform. We asked about new features we could add and how we could simplify configuration options that would provide dynamic, actionable insights to help them make (and…

-

Fintech kicks off card program using GOBLIN platform to merge four data streams

Challenge: One of PAG’s clients – a medium-sized fintech with a long history of customer loyalty – wanted to enter the U.S. card market to leverage its strong customer relationships. The client also had good data history on their customers through its non-card products, but it was in multiple legacy systems and the data was…

-

Beating Back the Beast: Cybersecurity in the Financial World

You read all the IT reports, you follow their recommendations, and you pay attention when they inform you of risks and problems. Many of your associates or those you know do the same. Yet somehow, you still hear about breaches in businesses everywhere, including your personal network. The reality of the current climate is that…